How many hits do you think come up when you google the words: “best time to buy real estate”? You’re no idiot. A lot, right? What you don’t realize is how f’ing many. There are three billion hits when you drop the set of words “best time to buy real estate” into google, and a swaggering 122 million when you add “in Toronto” to the backend of those words.

So What’s The Answer?

I won’t beat around the bush. The best time to buy real estate in Toronto is simply NOW.

I know what you’re thinking. (In fact, I can imagine your internal monologue is going something like: “Of course it’s a good time to buy real estate in Toronto. You and every other agent think all the time is a good time to buy real estate in Toronto.” ) I get it. Because some part of that is true. Real estate agents by large are conditioned to tell you that every time of the year is a good time to buy real estate and that every time’s a good time to sell it. Regardless when you ask us. It’s just how it is. Don’t hate me. It’s called s-a-l-e-s.

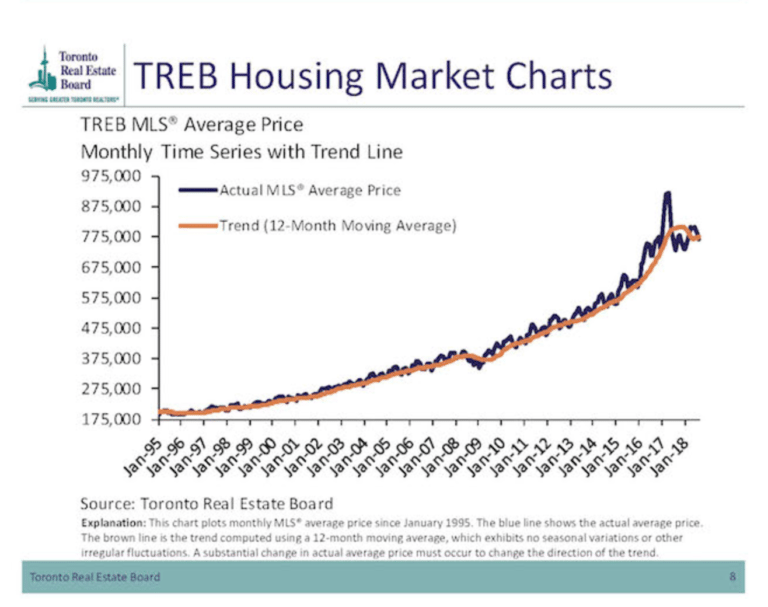

But…here in Toronto? It’s true. It’s so true you can’t even afford to dismiss me and close this page. I’ve said it before and I’ll say it again. There’s never been a better best time to buy real estate in Toronto because every single day it becomes more expensive. Don’t believe me? This graph charting 2 decades of Toronto price growth is proof in the pudding, other than that world-news-level-drama at the height of 2017.

Toronto first-time home buyers often believe the best approach to entering the market is to take the extra time to save for a larger down payment in order to reduce their monthly mortgage payment. Unfortunately, given the dynamics of the Toronto real estate market, this thoughtful approach can mean getting less, if not getting simply priced out.

Scenario Time!

Let’s use Fernanda and Jon as an example. (hee hee if you recognize where I borrowed those from).

Fernanda and Jon are first-time home buyers in Toronto and have been pre-qualified based on their combined income to purchase a property in the $750,000 price range. They have currently saved $50,000 – enough for the minimum down payment – but hope to save an additional $12,000 over the next year (at a rate of $1,000/month) so they can reduce their mortgage payments.

The challenge: one year later the same $750,000 property they were looking at now costs $810,000 (based on the average annual growth rate over the past 10 years per Toronto Real Estate Board – TREB – statistics). Despite their additional $12,000 in savings, not only would their mortgage payments and closing costs be much higher, they wouldn’t even qualify to buy their target home. Combine this with increasing interest rates and more restrictive mortgage qualifying ratios and guidelines, and it is no wonder it feels like homes are running away from potential buyers.

What’s the Solution?

Rid the idea that your first property will be your dream property. Rid it. A’int gonna happen. The only way to achieve your dream property is (1) to win the lottery or have parents with deep pockets willing to share a huge chunk, or (2) to move up the property ladder.

If Fernanda and Jon (our example above) have been approved for a $750,000 property budget, I’d suggest they drop everything and start seeing what’s possible. As in, not 5 months from now. TODAY. CALL ME. They should ration their monthly spend on entertainment and travel expenses in lieu of taking another year to save $12,000.

My recommendation if they want to stay in Toronto? (1) Firstly, toss out the idea they can buy a house (unless they are geared up for a big reno and the costs associated) and (2) cast their sight on a two bedroom condo in the city core with a parking spot, in a good neighbourhood. It need not be their dream home, but it will be one that can check off their needs. In one year at a conservative 7% y/o/y (year over year) appreciation, that condo is now worth $52,000 more. That’s a lot more than what they would have even initially saved during that time. And in 5 years, using the same estimate on appreciation above, that condo is now worth $262,000 more. Now they have equity plus appreciation to use to move on up.

If you were to buy now at the current rate of appreciation (using December, 2018 latest TREB data), THIS is what you could see:

11.55% (current y/o/y appreciation in Toronto CO1 condo sector) = $433,125

For you naysayers who predict we won’t be holding at 11.5% y/o/y for 5 years (and fair enough), let’s look at a more conservative estimate. Toronto home prices have steadily climbed. On a compound annual growth rate basis, Toronto properties (all TREB regions) have grown 8.6% per year over the past 5 years, 7.6% per year over the past 10 years, and +6.7%* per year over the past 20 years. There are market blips you read about in the media reflective of short-term volatility that occur in any market. But, if you step back and look at the longer-term picture, the growth in Toronto real estate prices has been very consistent.

So let’s try those numbers on with Fernanda and Jon’s $750,000 condo purchase.

6.7% (average over the past 20 years) = $251,250

7.6% (average over the past 10 years) = $285,000

8.6% (average over the past 5 years) = $322,500

It might be impossible for you to imagine a tiny 700 square foot 2 bedroom condo being worth a million dollars or more in 5 years, but trust me, it is where we’re headed. Most of my clients who’ve bought more than two years ago with me have seen 6-figure gains in their property’s value (some of them 1 bedroom condo owners!).

Toronto is a high-demand real estate market, results being impressive only if you’re in it. While you’re sitting at the sidelines waiting, it’s just overwhelming. And tighter lending guidelines, rising interest rates, and escalation of costs will only do that more. The good news is, (1) you read this article in full so are in receipt of the initial information you need to know (aka, stop waiting), and (2) that there are real estate agents in Toronto, of which I am one, to help answer your questions. If you’re interested in learning more about affordability, please check out this presentation by Outline Financial and/or contact me to learn how I can help you “get in” and build up.

**Special thanks to TREB and Outline Financial for amalgamating some of the above data.